A Comprehensive Guide to Managing Your Wealth

Understanding money and finance is essential in today’s fast-paced world. Whether you are an individual looking to improve personal finances or an entrepreneur managing a business, mastering financial literacy is key to achieving long-term success. This guide covers the essential concepts, strategies, and tips to help you take control of your money and make informed financial decisions.

1. The Basics of Money

1.1 What is Money?

Money is more than just currency; it is a tool that facilitates trade, stores value, and serves as a unit of account. It allows individuals and businesses to exchange goods and services efficiently.

1.2 Types of Money

- Cash: Physical money like coins and banknotes.

- Digital Money: Online balances, digital wallets, and bank transfers.

- Cryptocurrency: Decentralized digital currencies such as Bitcoin and Ethereum.

- Credit: Borrowed money that must be repaid with interest.

1.3 The Role of Money in Society

Money impacts every aspect of life, from basic needs like food and shelter to investments and wealth accumulation. It also shapes economic policies and global trade systems.

2. Personal Finance Management

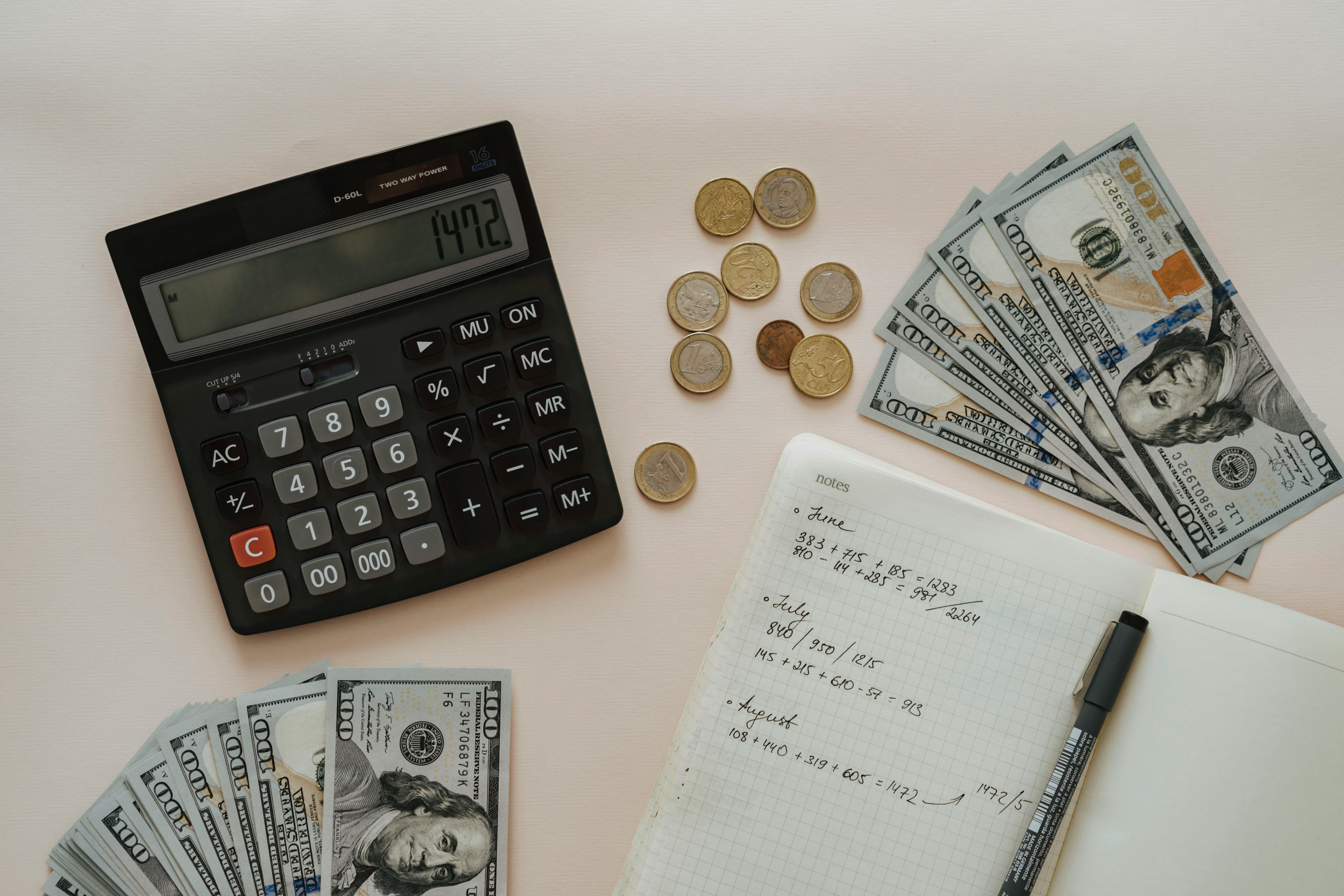

2.1 Budgeting

Budgeting is the foundation of personal finance. It involves tracking income, expenses, and savings to ensure financial stability.

- Calculate monthly income and expenses.

- Identify essential and discretionary spending.

- Set financial goals and allocate funds accordingly.

2.2 Saving Strategies

Saving is crucial for future security and achieving financial goals. Consider these approaches:

- Emergency Fund: Keep 3-6 months of living expenses for unexpected events.

- High-Interest Savings Accounts: Maximize returns while keeping money accessible.

- Automated Savings: Schedule automatic transfers to avoid spending temptations.

2.3 Debt Management

Managing debt responsibly prevents financial stress and improves credit scores. Key strategies include:

- Prioritize high-interest debts.

- Negotiate lower interest rates or repayment terms.

- Avoid accumulating unnecessary debt.

2.4 Investing

Investing helps grow wealth over time and beat inflation. Popular options include:

- Stocks: Shares of companies offering growth and dividends.

- Bonds: Fixed-income securities providing steady returns.

- Mutual Funds: Pooled investments managed by professionals.

- Real Estate: Property investments for long-term appreciation and rental income.

- Retirement Accounts: 401(k), IRA, or pension plans for long-term security.

3. Financial Planning

3.1 Setting Financial Goals

Clear financial goals provide direction and motivation. Goals can be short-term, like saving for a vacation, or long-term, like buying a house or retiring comfortably.

3.2 Risk Management

Financial planning requires evaluating risks and preparing for uncertainties. Consider:

- Insurance: Health, life, and property insurance protect against major financial setbacks.

- Diversification: Spread investments across multiple asset classes to reduce risk.

3.3 Retirement Planning

Planning for retirement ensures financial independence in later years. Strategies include:

- Contributing regularly to retirement accounts.

- Investing in diversified portfolios with long-term growth potential.

- Adjusting lifestyle and expenses to align with retirement goals.

4. Understanding Financial Markets

4.1 Stock Market

The stock market allows investors to buy and sell company shares. Key principles include:

- Understanding market trends and cycles.

- Analyzing company financials and growth potential.

- Investing for long-term gains rather than short-term speculation.

4.2 Bonds and Fixed-Income Securities

Bonds provide a fixed return over a set period, making them suitable for conservative investors. They are less volatile than stocks but generally offer lower returns.

4.3 Cryptocurrencies

Cryptocurrencies are digital assets that operate on decentralized networks. They offer high growth potential but come with significant volatility and risk.

4.4 Commodities

Investing in commodities like gold, oil, or agricultural products can hedge against inflation and diversify an investment portfolio.

5. Money Management Tools and Techniques

5.1 Financial Software

Tools like budgeting apps, accounting software, and investment trackers can simplify money management:

- Track expenses automatically.

- Visualize spending patterns.

- Set reminders for bills and payments.

5.2 Automation

Automating savings, bill payments, and investments reduces human error and enforces discipline.

5.3 Regular Financial Review

Reviewing finances monthly or quarterly helps you stay on track with goals, identify unnecessary expenses, and adjust strategies as needed.

6. Financial Mindset and Education

6.1 Developing a Wealth Mindset

A positive financial mindset is critical for building wealth. Focus on:

- Understanding the value of money.

- Learning continuously about investment opportunities.

- Practicing patience and long-term planning.

6.2 Financial Education Resources

Learning is ongoing. Utilize these resources:

- Books on personal finance and investing.

- Podcasts and online courses.

- Financial news and market analysis websites.

7. Common Financial Mistakes to Avoid

- Overspending and failing to budget.

- Neglecting savings and emergency funds.

- Investing without proper research.

- Ignoring debt repayment and credit scores.

- Succumbing to impulsive financial decisions.

8. Conclusion

Mastering money and finance requires knowledge, discipline, and consistent effort. By budgeting, saving, investing wisely, and continuously learning, you can achieve financial security and build wealth over time. Remember, financial freedom is not just about how much money you make, but how effectively you manage and grow it.

"Do not save what is left after spending, but spend what is left after saving." – Warren Buffett

Leave a comment

Your email address will not be published. Required fields are marked *