Sources of Income 2025

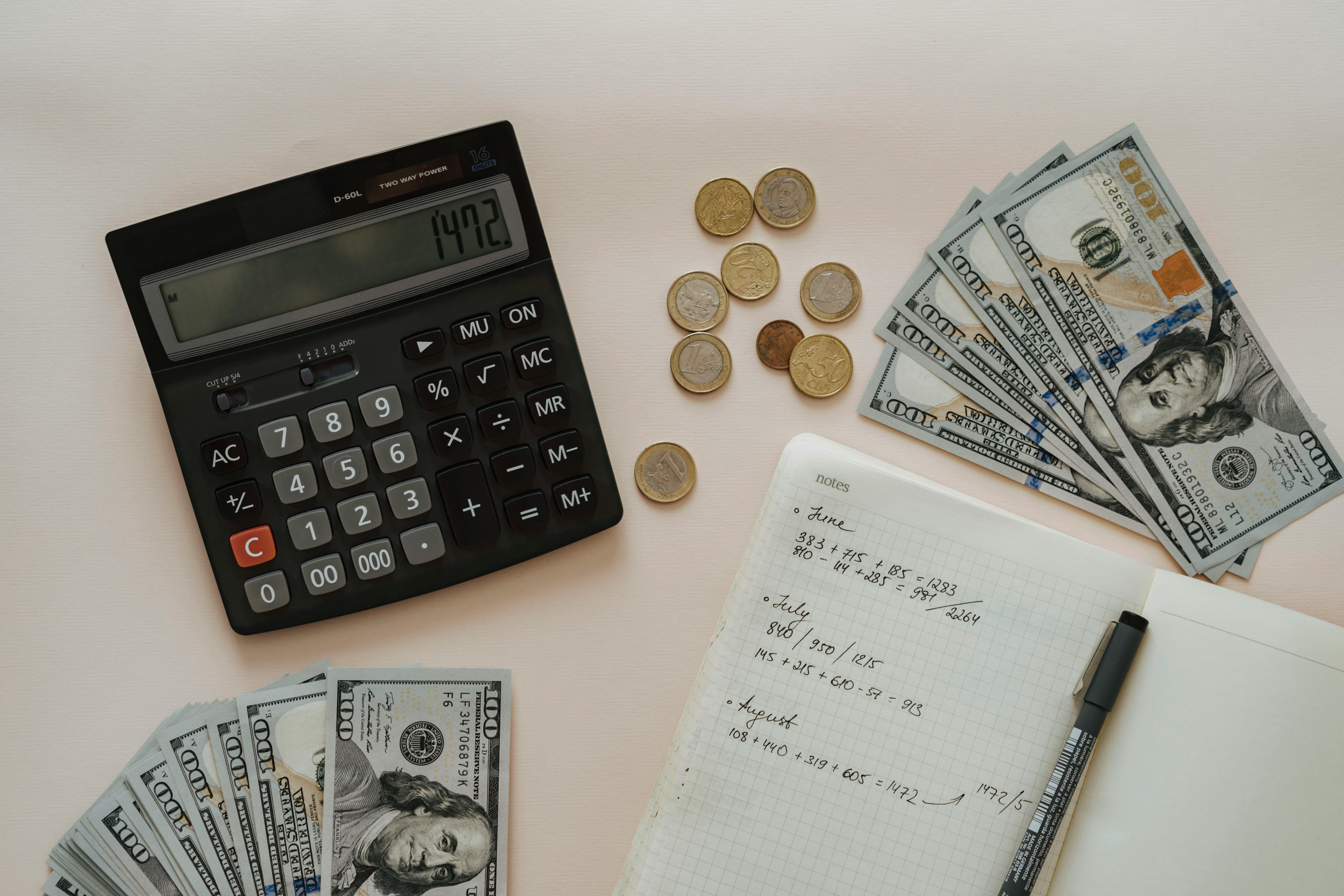

In 2025, the world of income generation is evolving faster than ever. With digital transformation, remote work, and new financial tools, individuals now have more opportunities than at any point in history to diversify their sources of income. Understanding these sources and learning how to leverage them can help you build financial security, achieve independence, and prepare for future uncertainties.

"Never depend on a single income. Make investment to create a second source." – Warren Buffett

This guide explores the main sources of income in 2025, from traditional employment to innovative digital opportunities. You’ll learn about active income, passive income, online businesses, and investment strategies suitable for the modern economy.

1. Understanding Income Categories

Before diving into the sources of income, it’s important to understand how income is classified. In general, there are three primary categories:

- Active Income: Money earned directly through work, such as salaries or freelance payments.

- Passive Income: Earnings generated with little ongoing effort, like rental income or dividends.

- Portfolio Income: Profits from investments such as stocks, bonds, or crypto.

These categories overlap, and successful individuals often combine them to create multiple revenue streams.

2. Traditional Sources of Income

2.1 Employment Income

Despite new opportunities, employment income remains the backbone of financial stability for millions. In 2025, jobs have become more flexible, with hybrid and remote positions dominating many industries.

Key benefits of employment:

- Stable and predictable salary

- Health and retirement benefits

- Opportunities for career growth

2.2 Self-Employment and Freelancing

Freelancing has surged in popularity, with platforms like Upwork, Fiverr, and specialized niche marketplaces connecting skilled workers with clients worldwide.

Examples of freelance opportunities:

- Writing and content creation

- Graphic design and 3D modeling

- Web and app development

- Consulting and coaching

3. Digital and Online Sources of Income

The internet has unlocked countless ways to earn money, making online income one of the fastest-growing categories in 2025.

3.1 E-commerce and Online Stores

With platforms like Shopify, WooCommerce, and Amazon, anyone can launch an online store. Dropshipping, print-on-demand, and digital product sales are thriving in 2025.

3.2 Content Creation

Content creators on YouTube, TikTok, Twitch, and podcasts are monetizing through ads, sponsorships, and subscriptions. Many build loyal audiences and turn hobbies into profitable businesses.

3.3 Blogging and Affiliate Marketing

Blogs remain powerful tools for generating income. By combining SEO strategies and affiliate marketing, bloggers can earn passive income through commissions.

3.4 Remote Digital Work

High-demand skills such as coding, video editing, and virtual assistance can be offered online to global clients. Remote work has become a reliable income source across industries.

4. Investment-Based Income

4.1 Stock Market and ETFs

Investing in stocks and exchange-traded funds (ETFs) is one of the most common portfolio income sources. With platforms offering fractional shares, investing is more accessible than ever.

4.2 Real Estate Investments

Rental properties, real estate investment trusts (REITs), and Airbnb hosting continue to be profitable in 2025, especially with the rise of remote work tourism.

4.3 Cryptocurrency and Blockchain Assets

Although volatile, cryptocurrency remains a source of income for traders and long-term investors. Decentralized finance (DeFi) platforms also allow users to earn interest or staking rewards.

4.4 Bonds and Fixed-Income Investments

For stability, many investors rely on government bonds, corporate bonds, and fixed-income securities, which provide predictable returns.

5. Passive Income Opportunities

5.1 Dividend Stocks

Companies that share profits with shareholders through dividends offer a reliable form of passive income. Reinvesting dividends can accelerate wealth growth.

5.2 Peer-to-Peer Lending

P2P platforms connect lenders with borrowers, providing investors with interest income. This is riskier than traditional investments but can yield higher returns.

5.3 Royalties

Writers, musicians, software developers, and inventors can earn royalties for their intellectual property, creating long-term passive income.

5.4 Automated Businesses

Businesses that run with minimal involvement, such as vending machines or dropshipping stores with automated systems, represent modern passive income models.

6. Emerging Sources of Income in 2025

6.1 AI and Automation Services

The rise of AI tools has created opportunities for freelancers and entrepreneurs to provide automation solutions, AI-driven customer service, and chatbot management.

6.2 The Creator Economy

Platforms like Patreon, Substack, and OnlyFans allow creators to directly monetize their audiences without relying solely on advertisers.

6.3 The Metaverse and Virtual Real Estate

Virtual real estate and digital goods in metaverse platforms are becoming lucrative. Users buy, rent, and sell virtual land for significant profits.

6.4 Green and Sustainable Businesses

Eco-friendly startups and renewable energy projects are not only solving environmental issues but also creating profitable opportunities.

7. How to Diversify Your Income

Relying on a single source of income is risky. Diversification ensures financial security in uncertain times.

Steps to diversify:

- Start with a primary active income (job or freelancing)

- Build at least one passive income stream (investments, royalties)

- Explore digital opportunities (e-commerce, content creation)

- Allocate a portion of earnings to long-term investments

- Continuously upskill to adapt to new trends

8. Challenges and Risks

While opportunities are abundant, each income source comes with risks. Understanding them is crucial before diving in.

- Market Risks: Stocks and crypto fluctuate rapidly.

- Time Commitment: Some businesses require years to grow.

- Skill Requirements: Not all income sources are beginner-friendly.

- Scams: The digital world is filled with fraudulent schemes.

Conclusion

In 2025, there are more sources of income than ever before. From traditional jobs to cutting-edge opportunities in AI, crypto, and the metaverse, individuals have the tools to build wealth and achieve independence. The key lies in diversification, adaptability, and continuous learning.

Whether you’re just starting your financial journey or looking to expand your wealth portfolio, the time to take action is now. Explore multiple income streams, invest wisely, and embrace the digital economy to secure your financial future.

Leave a comment

Your email address will not be published. Required fields are marked *